OWL Updates

Decision Frameworks regularly adds new and interesting case studies, that reflect changing business conditions and decision challenges. Once installed, OWL checks for new or updated content and downloads these in the background.

New Case Release February 13, 2024

Decision Frameworks has added six new chapters to the Organizational Wisdom Library. Below are breif descriptions of each case which can be found in your OWL software starting February 13, 2024.

Holly (Energy Transition/Scenario Planning) – Holly is a business expansion decision facing many external business landscape uncertainties. The company, Holly, is an international manufacturing and software company that designs commercial smart devices. Their largest customer bases are the Americas and Western Europe. However, market trends indicate an increasing demand for their products in Asia, Eastern Europe, and Latin America.

Several avenues of expansion are being debated, from buying an existing plant, to investing in the construction of a new plant and partnering with regional companies. Uncertainty in the pace of energy transition trends, the global economic environment, and geopolitics in the regions of interest make this a difficult choice.

Romeo (Energy Transition/Scenario Planning) – Romeo is a field development decision investigating how best to address energy transition and profitability goals while facing regulatory and market uncertainties. Shakespeare Oil and Gas has a recent discovery in the offshore Romeo field. The team is unsure of how to proceed. While Romeo will be developed, there are decisions about the end-product that will serve as the source of revenue, and many development concepts are being considered. Some on the team favor a standalone concept that could capture Romeo’s upside potential and provide optionality for future discoveries (third party or their own) while others lean towards more conservative tie-back options.

The future regulatory climate will impact overall development options. As such, the team is unsure whether to focus on hydrocarbon production and/or invest in concepts that also support current and future potential ESG goals.

Boomerang (Energy Transition/Carbon Policy Impact) – Boomerang is a CCUS decision investigating the impact of carbon policy on different opportunity development options. Enviro Oil has recently acquired Boomerang, an older offshore asset with recovery optimization options. The company is considering many ways to re-develop the field including ESPs (electric submersible pumps) or adding equipment to take advantage of Boomerang's high content CO2 field gas and/or nearby third-party CO2 emissions.

Project development options are evaluated considering different carbon policy scenarios currently in place around the world. Thus, providing insight and answering the question, “under what terms and conditions, (carbon policy support, technology advancement, and market conditions) can different project options be economic and help the company meet their path to net zero objectives?”

Magnus (Energy Transition/Carbon Policy Impact) – Magnus is a carbon capture strategic planning decision. The global company has a portfolio of industrial facilities and an aggressive path to net zero goals. Magnus owns four main facility types: Refining & Petrochemical, Gas-Fired Power Plants, Ethanol Production Facilities, and Hydrogen (SMR) Production Facilities. They are located around the world in different carbon policy environments which provide varying degrees of support to capture CO2.

The different types of facilities are evaluated in different carbon policy scenarios. Thus, providing insight and answering the question, “under what terms and conditions can each facility type economically install carbon capture so that plans can be put in place?”

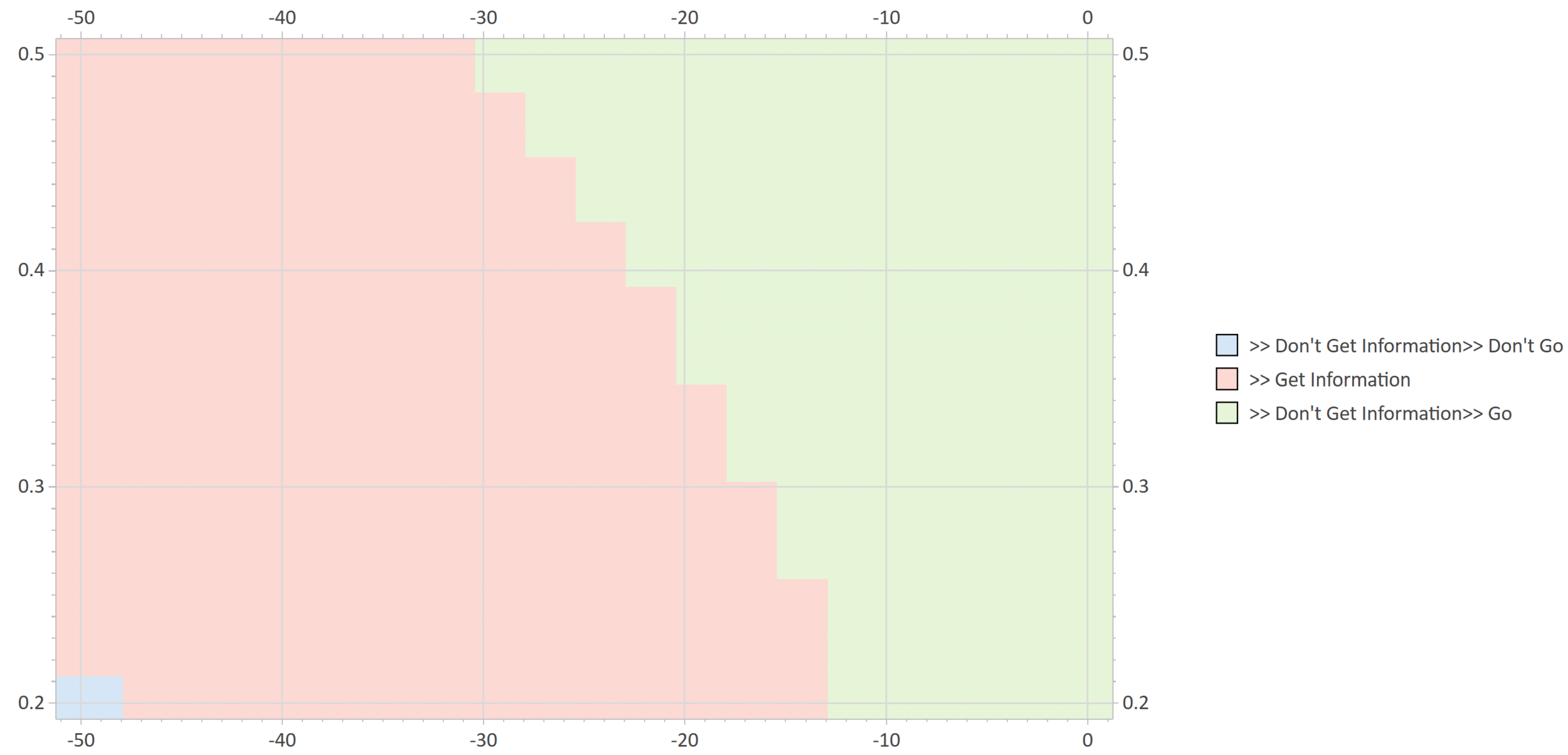

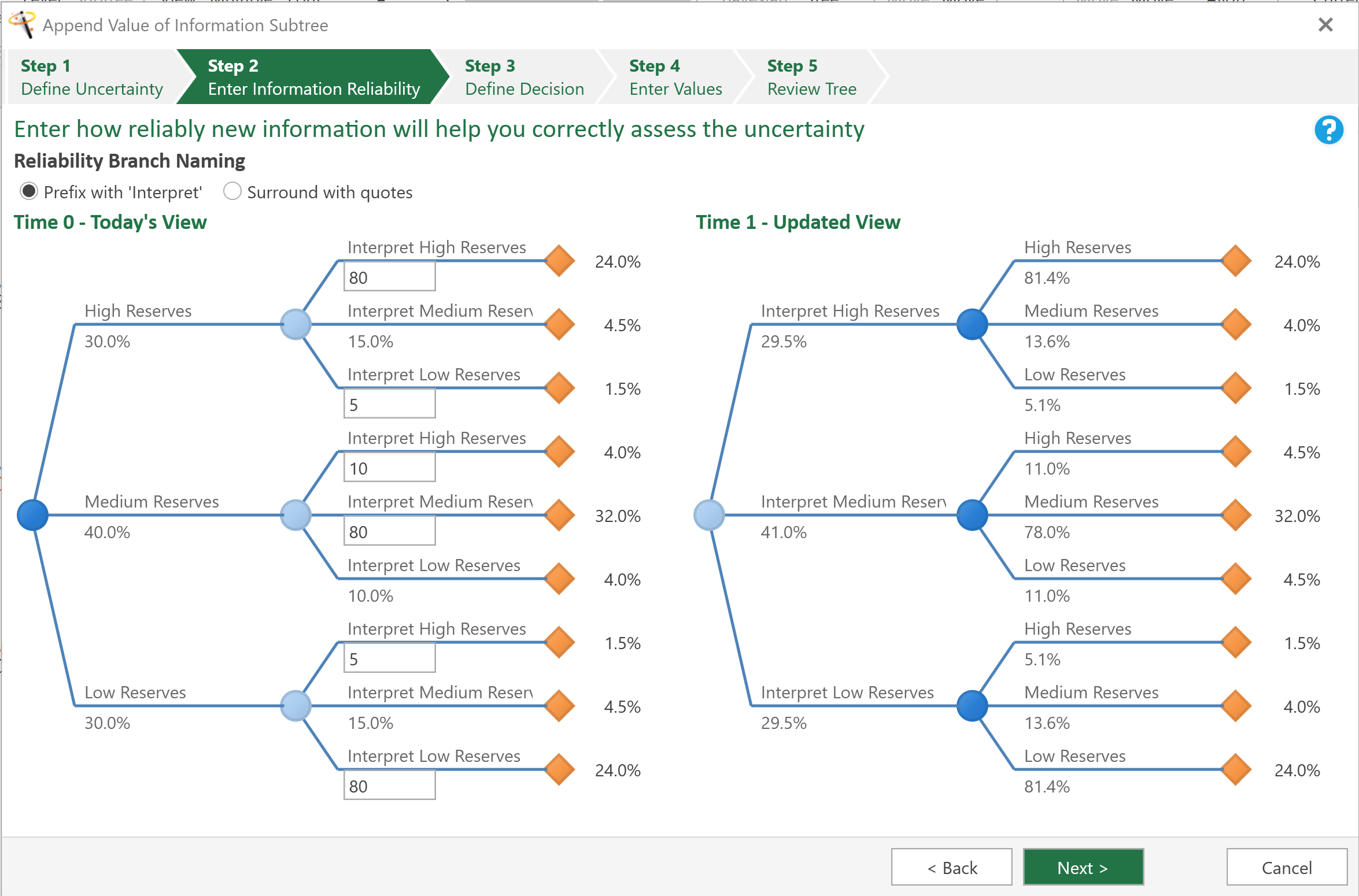

Vie Verte (Energy Transition/Technology Pilot Value of Information) – Vie Verte is an energy transition value of information pilot decision. The company is a fuel refiner that has developed a promising algal bio-oil technology. Up to this point, they have relied on partners to obtain alternative energy fuels to remain compliant with the Renewable Fuel Standards (RFS) Program, but this bio-oil may present a new opportunity.

Vie Verte must decide what the correct course of action is to prove the viability of their bio-oil technology and are considering different pilot options. Bringing the new product straight to market would be advantageous to capture rising demand, but there currently is no proof of concept that their bio-oil would be successful. Some on the team believe that a pilot would be the most prudent path forward, but even then, the team must decide the best pilot size, weighing both cost and reliability.

Morpheus (Exploration Strategy) – Morpheus is an exploration lease strategy decision. The company recently acquired 100% equity in an isolated exploration block in deepwater. There currently is no nearby infrastructure in the area. However, another oil company has made two oil discoveries in one of the Morpheus plays on the adjacent acreage. The team is debating many aspects of their lease strategy including offering the neighboring company an opportunity to farm into their acreage, sharing a rig to manage costs, and the order of plays to pursue.

From the regional course-grid seismic, Morpheus has mapped two plays on the block, the Green and Blue, which contain two and four prospects, respectively. The Blue play is mapped as an extension of the “string of pearls” from the neighboring block. In discussions with the team, management has suggested that they would like to understand which play looks most economically attractive and why. They’d also like to understand the chance of getting an economic development and how that may change as they commit to drill more wells in the exploration program (dry hole tolerance).